Using the equity in your home to finance a major purchase is a great alternative. MidCountry Bank makes the decision even easier by taking away the uncertainty of your payment. Lock the rate on some or all of your balance when the time is right!

Home Equity Line4Me offers the ultimate flexible financing for:

- Home improvement projects

- Education costs

- Dream vacations

- Major purchases

- Debt consolidation

- Emergency fund

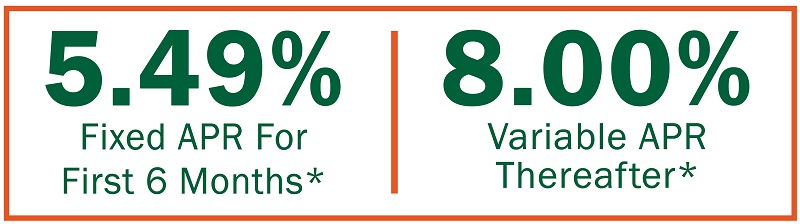

Home Equity Line of Credit Special

*Limited time offer and subject to credit approval and underwriting standards. Rates, terms and conditions effective as of 3/3/2025. Promotional rate of 5.49% Annual Percentage Rate (APR) will be in effect for the first 6 months for qualified applicants. Thereafter, the APR is variable, subject to change, and consists of the Prime Rate as published in the Wall Street Journal (currently 7.50%) plus a margin of 0.50% for the life of the loan. After 6 month promo period your maximum APR is 18% and minimum APR is 6.00%. Offer valid for new loans with a minimum of $50,000 approved. Current MidCountry Bank Home Equity Line of Credit customers are excluded. Promotional APR also requires an automatic payment from a MidCountry Bank deposit account with a balance of $500 or more. Standard rates are applied to loans with payments made by other methods. This promotional rate assumes a credit score above 750 and LTV of up to 80.00%. If the borrower does not meet qualifying criteria, the APR may range up to Prime plus a margin of 4.00% and will be determined by the occupancy status of the property, combined LTV and credit worthiness. Standard closing costs apply, with borrowers responsible for certain fees to third parties such as appraisers, credit reporting firms and government agencies, which are generally between $0 and $2,500. Promotional APR does not apply to HELOC conversion feature. Property insurance is required. Owner occupied properties only. Offer only available to properties in MN and WI.

Helpful Articles and Insights

Learn More About:

Additional Services:

Login

Login